EU and Irish Policies on E-Commerce

E-commerce is exciting, and after reading E-Commerce in Europe and Ireland and E-Commerce Platforms, you know some of the best ways to do it. However, you need to be certain that you are following all the rules and regulations. While we will cover some here it is in your best interest to contact an experienced solicitor to answer any legal questions you may have.

Just a heads up, as “mere conduits,” network operators have no legal liability for the consequences of traffic delivered via their networks (Directive 2000/31/EC). Therefore, if something goes wrong, you can’t blame your network operators. And that means that you are responsible.

You should also know that because there are 28 individual markets in the EU, you need to be aware of hundreds of location-specific rules and regulations (National Board of Trade). There are, of course, a few things you should always do: file all proper taxes, secure customers’ information, and comply with online advertising regulations (Ecommerce Guide).

European E-commerce

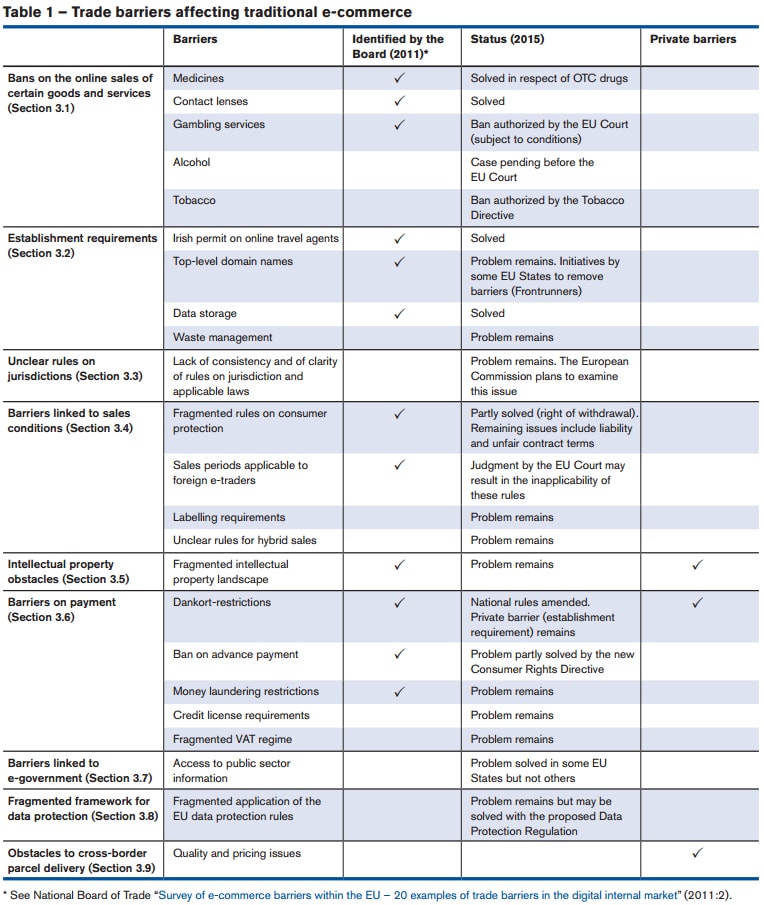

While the EU is working to create a border-less e-commerce environment, they still face many obstacles. Below are a few of the concerns about European e-commerce:

- Local labeling requirements

- Legally regulated special sales

- Most notably for France

- Partial ban on the online sale of alcohol

- Restrictions on top-level domain names

- Some physical presence required certain countries; for example Germany, Estonia and Norway

The most important aspects of the above table for business are the changes made on payment and sales conditions. Now there is more assurance for sellers and protection for buyers; however, some of the rules about physical location still remain. Most of the changes are positive for e-commerce as a whole. There have been improvements in terminology that should open up the EU to more e-commerce

Most of these issues are either fixed or pending, which have or should make e-commerce easier in the future. You should note that there are some regulation that are specific to different countries.

Irish E-commerce

In Ireland businesses must comply with the Sale of Goods and Supply of Services Act and the Consumer Protection Act, as well as additional e-commerce guidelines (NCA Business Guides, NCA Sale of Goods, and NCA E-commerce).

The Competition Authority and the National Consumer Agency have created a quick checklist of regulations for selling via e-commerce:

- Full details of the service provider including your geographical address and email address

- Special offers such as promotions (discounts, premiums, gifts) and promotional games should be clearly identifiable, with information about their terms and conditions

- Unsolicited offers not requested by the consumer should be prominently displayed on your website and at every point where they are asked to provide information (such as a form)

- Your registration number if you are registered in a trade or public register

- Your VAT registration number if the activity is subject to Value Added Tax

- Where the activity is subject to an authorisation scheme, the details of the relevant supervisory authority

- If you as the service provider are a member of a regulated profession, any professional body or similar institution with which you are registered; your professional title and the EU member state where it has been granted; and a reference to the relevant professional rules in the member state of establishment and the means to access them

While goods and services themselves are excluded from the distance selling regulations, they are still covered by the e-commerce regulations.

So now you know what is going on with e-commerce in Europe and Ireland, how you can use e-commerce for your business, and what you absolutely need to know about regulations on e-commerce. So go on. Get started. Grow your business with e-commerce.

Not sure where to start? Contact us and we’ll be happy to help.